1. Used EV Market Thriving with 35% Growth

Most forecasts correctly projected a loss of momentum in new EV sales in Q4 2025 after 6 years of steady growth. However, surprising news came from the used EV sector:

- December sales were up 10.2% year over year

- December sales rose 9.7% from November

- Total 2025 used EV sales increased 35% from 2024

This reality matches what dealers on the ground are seeing, and aligns with their expectations for EV sales in 2026.

As used EVs leave behind the wild price volatility we saw in the first part of the decade, they enter a stable and mature market. Although the data below shows winter price drops, they correspond with those seen across the entire used car market.

With no impending policy changes and plenty of exciting inventory from lease returns, now is a great time for dealerships to capitalize on used EVs.

.png)

Here's where the used EV market stands.

As of January, 56% of inventory is under $30,000 and 30% of these lower entry-point vehicles are from 2023 or newer. Of cars from all price segments, 55% of vehicles are 2023 or newer model years.

Tesla’s long market lead is reflected in overall pre-owned market share: 30% inventory is Teslas, which are showing a lot of price stability both before and after the tax credits ended (although the announcement about Model X and Model S discontinuation may affect their residuals).

- 13.74% - Model 3 - $26,755.90

- 9.33% - Model Y - $32,712.00

- 3.92% - Model S - $39,872.93

- 2.38% - Model X - $48,384.82

After used Model 3 and Model Y, 2023 Volkswagen ID.4, Nissan Ariya, and Ford Mustang Mach-E are well represented in vehicle inventory.

2. Used EV Value Advantage Is Growing

Just this week Car Dealership Guy pointed out:

"Years of weak new-vehicle sales hollowed out the used supply, leaving buyers with inventory that’s 30–40% more expensive than what they remember and far fewer sub-$20K options."

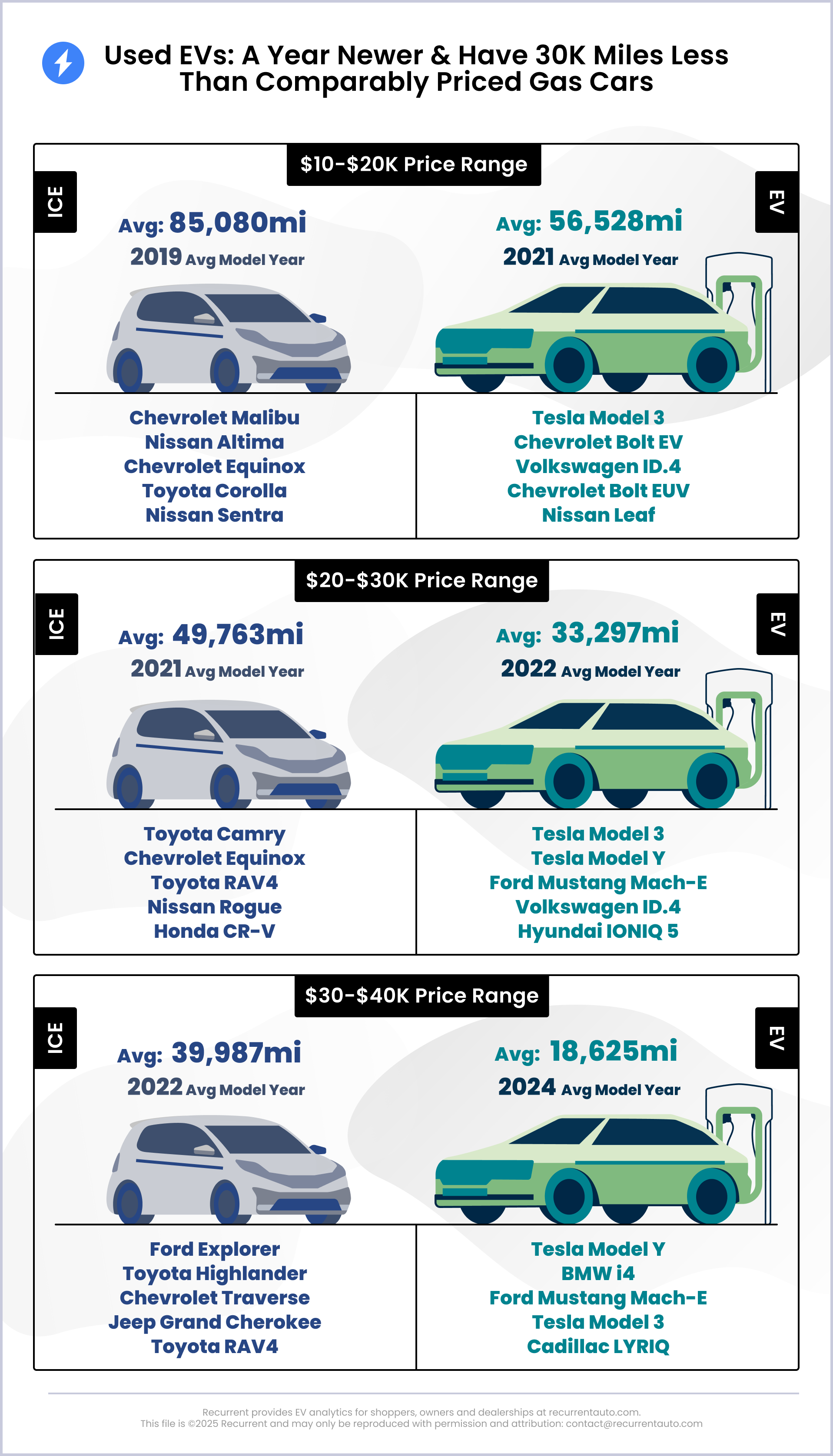

Meanwhile, used EV inventory offerings remain well poised to compete with gas cars, offering newer models and low mileage on lease returns:

- 55% is 2023 or newer; 68% 2022 or newer; 82% is 2020 or newer

- 39% of models selling for under $25,000

The value difference is most striking for cars under $20,000, where the average EV is 2 years newer than a comparably priced gas car, and has 40,000 fewer miles.

“The used market in EVs is a very unique space. The value you get out of a used EV right now is extreme. The type of vehicle you’re getting on a used lot is, let’s say if it’s not luxury, it’s near luxury at a similar price to a Honda Accord. So you’re getting a pretty great EV…You can get Polestar 2s, you can get Tesla Model 3s or Ys that’s similar to an Accord price.”

- David Thomas, CDK Global

“That’s one of the things about used EVs that is easier to sell…all of them are packed with technology and they come standard with all of these phenomenal features yet because of the inherent uncertainty they depreciate quite aggressively. Your competitive vehicle will be an older car with more miles and less features. It’s hard to justify buying an ICE Camry versus a Polestar 2 if they’re the same price and the same year, just based on features alone. When you sit in those two vehicles, they just don’t feel like they’re in the same price point.”

- Joel Bassam, Easterns Automotive

3. LFP Batteries Drive Affordability and Longevity

LFP batteries are a type of lithium ion battery that have been increasingly adopted by many EV makers. They are up to 30% cheaper than the more common nickel-based (NMC) batteries. In addition, LFP batteries are highly stable and more resistant to heat degradation than their lithium ion cousins. They are also known as lithium iron phosphate, or LiFePO4 batteries.

One of the promises of LFP batteries is longer cycle life. At the cell level, NMC battery cells generally have a cycle life of 1,500–2,000 cycles until they hit 80% original capacity, while LFP cells typically reach approximately 4,000 cycles. In real-world EV battery packs, the numbers come down a bit because pack performance depends on the weakest cell, but LFP still outlives NMC by 2-3x.

Recurrent has investigated LFP battery behavior in our community of drivers, comparing 2022-2023 Teslas - some with LFP and some with NMC. The preliminary results show promise that LFP packs are degrading more slowly.

.png)

These are popular pre-owned EVs available with LFP batteries:

- Ford Mustang Mach-E - Starting in late 2023, base trims are equipped with a 73-kWh LFP pack.

- Rivian R1S and R1T - Newer R1S and R1T offer a 92.5-kWh LFP battery on their entry-level dual-motor Standard models.

- Rivian Commercial Van (EDV) - Rivian's fleet vehicles feature a 100-kWh LFP pack.

- Ford F-150 Lightning - Ford planned to add LFP as a standard-range option on the Pro and XLT trims during the 2024 model year, but it was flagged as a "late availability" option and there's limited confirmation it actually shipped in volume.

- 2027 Chevrolet Bolt - 65-kWh LFP battery.

- Tesla Model 3 (base/RWD) - The LFP-powered Model 3 used a Chinese-made LFP battery which was discontinued in the U.S. in October 2024 after the Biden administration hiked tariffs on imported EVs and batteries. They can still be found on the used market.

About this data

The data in Recurrent’s quarterly reports comes from our partner, Marketcheck.

Previous Reports

Each quarter we publish a new report with the latest industry data. Browse this section to review previous reports and their findings.

Q3 2025 Report

- The used EV market is quietly thriving. Used EV inventory is up, and days supply down, all while prices climb. These market signals indicate healthy demand.

- The used Tesla crash that never happened. Used Tesla listings surged in Q2 to nearly twice previous levels. However, market prices have not plummeted and cars are not sitting on lots.

- Savvy dealers are selling some used EVs 6x faster. Rebate-eligible used EVs are selling six times faster than comparably priced and comparably aged non-eligible used EVs.

Q1 2025 Report

- Federal rebate uncertainty is driving record EV sales to begin 2025, particularly with used cars, which have seen 2024 sales increase by 62.6% from 2023 numbers.

- EV lease rates are expected to decrease sharply from around 50% in 2024, but the used EV market will expand by more than 1,000,000 lease returns over the next 2 years.

- EV battery prices dropped 20%. Prices are trending for battery replacement costs to be lower than major gas engine work by 2030.

.webp)

Q4 2024 Report

- EV depreciation improves with market maturity and tax credit floor

- Why so many used EV values are converging around $25,000

- EV lease rates soar to double auto industry average

- Rebate-eligible used EV supply to double starting in January

.webp)

Q3 2024 Report

- Used EV prices are stabilizing so it’s a good time to jump back in if you’re a buyer, dealer, or seller.

- Expect supply constraints on used EVs until 2026, when lease returns boost inventory with gently used electric cars.

- The overall electric car market is still on track to hit nearly 50% by 2030 — full report here.

- Used EV prices and availability can vary dramatically by state — full report here.

.jpeg)

Q2 2024 Report

- Used EV prices continue to fall, increasing accessibility for more buyers.

- More than half of used EV sales are potentially eligible for a $4000 rebate.

- The average price of new electric vehicles will reach parity with the average price across the overall auto industry by the end of 2024. As of today, it is only $2000 more before factoring in any federal rebates.

- Many tax credit eligible new EVs are already less expensive than the average car.

- This year’s Best Used EV is announced.

.webp)

Q4 2023 Report

- The average listing price of a used Tesla Model 3 has fallen below $30,000 for 2017 to 2019 vehicles, putting roughly 300,000 used EVs within reach of a federal rebate.

- Tesla may also be incentivized to slash prices again on some new models since it is expected that many new Model 3 vehicles will no longer receive a new-car EV tax credit in 2024.

- Used EV sales volume in 2024 will increase by roughly 100% over 2022 and 40% over 2023.

- Only 7% of U.S. car dealerships have taken steps to register for time-of-sale rebates, which could make it difficult for buyers to capture the instant savings.

Q4 2023 Report

- Used EV sales, as a segment, now dwarf the sales of every new EV model besides Tesla Model Y and 3.

- The Recurrent Price Index, which tracks the overall used EV market pricing, has fallen 32% year-over-year to an average of $27,800 -- a level last seen in early 2021.

- Nearly 30% of used EVs now qualify for $4000 clean vehicle credit, just ahead of point-of-sale rebate regulations, beginning January 1.

.webp)

.webp)

Q3 2023 Report

- Used EV prices continue to fall, with nearly 40% of inventory is under $30K

- If you’re looking for a specific make or model of used EV, where you look matters. Here are states that have the most inventory by brand.

- Used Teslas hold their value – but not last year’s models. Tesla continues to drive down its own prices in a bid to capture market share, accelerating one-year depreciation.

.webp)

Q2 2023

- After two years of wild ups and downs, used EV prices are settling almost exactly where they were in April 2021. However, an influx of newer model-year vehicles into the second hand market keeps the average price market-wide around $38,000

- Used Teslas hold value better than most luxury cars despite five rounds - and counting - of price cuts to the full lineup since January.

- Metro areas with rapidly growing used EV markets share many characteristics: average commutes under 30 minutes, median age under 40 and median income in the mid-to-high $70K

.webp)

Q1 2023

- Used EV Market Triples in Size - the number of electric cars in inventory is not just a measure of a growing market. It also can indicate that vehicles are sitting longer on dealer lots, as a result of higher interest rates.

- Recurrent Price Index has fallen 17% from its July 2022 peak, driven by falling prices in the used Chevy Bolt and Tesla Model 3

- The number of used EVs that are potentially eligible for a tax credit is up 30%

Q4 2022

- Used EV prices are beginning to decline, albeit, slowly

- Only 12% of used EVs would qualify for a used car tax credit today

- Used plug-in hybrids will dominate tax credit eligibility early in the year

- Market data suggests that 2017 and older model year EVs are most likely to be eligible for used EV tax credits in 2023

Q3 2022 Report

According to our inventory data, derived from over 50,000 car dealers, roughly one third of the estimated 158,689 total EV sales in Q1 2022 were used cars – official Q2 numbers are still pending. In fact, after new Tesla sales, used EVs make up the second largest portion of EV purchases.

Some other quick stats before we dive into the theme of the quarter:

- The average price of used EVs in July 2022 was $40,714, well above the newly proposed $25,000 used EV tax credit limit.

- 17.9% of used EV sales in the past 90 days were under $25,000.

- The average minimum listing price for used EVs that Recurrent tracks (including lots of like-new 2022 "used" cars) is $29,400.

Read more about the Rise of the Used EV.

Q2 2022 Report

- Higher used EV prices are the new normal

- The rise of the "new" used car

- Chevy Bolt battery replacements prove that calendar age matters

- The Tesla Model 3 takeover is here

Q1 2022 Report

- It’s still a seller’s market for used EVs

- Used EV prices are continuing to rise

- Used EV prices still higher than used ICE prices

- New Tesla price hikes in 2021 are causing used Tesla prices to soar

- People are talking a lot about Tesla battery replacements

Q3 2021 Report

- Compares climbing used EV prices to all used cars

- Revisits the state of the used EV market six months after our first report

- Determines the percent of used EV values below an important $25,000 price point

- Monitors a significant contraction in used EV inventory by state

In July, both Recurrent sales data and national analyses suggested that used car prices were starting to level off. The past two months of price data is further evidence that the market has stabilized. For used EVs, we saw a 2.32% price increase in from July to August, and a 0.39% increase going into September. Meanwhile, the overall used car price index saw a decline of 1.5% from August to September, meaning that used EVs pricing outpaced the used combustion engine market. We will continue to track this trend after this year of anomalous pricing.

Despite the used car market leveling off, the ongoing semiconductor shortage is still affecting US automakers. Last week, GM announced that most US production would pause after Labor Day, and many other auto manufacturers foresee temporary layoffs and production slow downs. This suggests that although used EV prices may have stabilized, they will not go back down to pre-summer levels anytime soon. An EV can require ten times more semiconductors than an ICE car, so expect electric inventory to remain limited as buyers looking for new EVs compete with buyers in the used markets.

Our methodology to calculate the used EV price index is to use a representative sample of popular vehicles and compare national averages for retail prices. The models we included in our bundle are: 2017 BMW i3, Chevy Bolt, Tesla Model S; 2018 BMW 530e, Honda Clarity, 2018 Nissan LEAF; 2019 Audi e-tron, Tesla Model 3, VW e-Golf.

In March, Recurrent released its first used EV buying guide to highlight the growth of the market and report on trends that were not being covered by other automotive sources. Six months later, we have seen meteoric price increases, drastic inventory contractions, and a shift in what model years are most popular in inventory.

As of September 2021, over 48% of all used EVs in the US are under $25,000 and nearly 30% are under $20,000. The $20-$25K price range is the target for auto manufacturers looking to produce a mass market EV to win over everyday, budget-conscious drivers, as rumors of a Tesla Model 2 or Volkswagen ID.2 suggest. New EVs available for around $25K will inject the used market with a supply of reliable electric cars priced around $10-$15K in a few years, and attract new drivers to the electric market.

As reported in March, there had been an almost 50% increase in used EV inventory since summer 2020. However, since that report, the inventory number has dropped 21% despite a modest increase in the last 2 months. Supply has dropped at least 35% in top EV states since March. Both Oregon and Virginia lost over 63% of their inventory in six months. The only state that remained near constant was Tennessee, losing only a handful of total inventory since March. These numbers are consistent with the overall used car market, which saw unprecedented low inventory this summer.

Refreshing the used EV stock has been incredibly difficult with inventory shortages around the country, and dealerships are struggling to find cars to sell. This inventory shortage has several causes.

In part, it is due to the global semiconductor shortage, which is causing significant production delays in new cars. That has pushed shoppers to consider the used market. Since EVs require ten times the number of semiconductors as ICE cars, this is a strong effect in the used EV market.

Secondly, the market is still reeling from the pandemic: dealerships that initially scaled down their supply or offered deep discounts to move cars off their lots are now scrambling to replenish a fleeting inventory that is not being filled by rental car sellers or fleet vehicle turnover.

We can expect inventory to remain very tight through the end of 2021.

August 2021 Report

- Who sells the most used Teslas? The answer would depend on which model you’re interested in.

- How have the ongoing Chevy Bolt recalls impacted the market for used Bolts?

- How do lease rates for new EVs impact the availability of used EVs?

July 2021 Report

- Used electric car retail prices in June continued to climb, but at a slightly slower pace, which could indicate the beginning of a market equilibrium being reached.

- We looked at different brands to determine the most popular EV by state. Overall, Tesla continues to be the most popular used electric car brand, with 26% of the used market nationally.

- The Chevy Bolt and Tesla Model 3 are two of the most popular all-electric vehicles on the road today. We did a Bolt vs Model 3 comparison to learn how their individual battery is aging across makes, models, years and climates.

June 2021 Report

- Chevy Volt has found its way to the top of the used electric list by selling more than any other EV model. Combined with new Bolt sales in 2021, GM is having a very big year. Although there could be a surge in Model 3 inventory soon.

- Used EV prices are still climbing. We recorded another 9% increase in average prices over the last 30 days.

- Used Teslas sell faster than any other used EV. We reviewed the number of vehicle sales for various brands compared to the number in dealer inventory to arrive at a relative proxy of used car turnover. Tesla is way ahead.

May 2021 Report

- Used EV prices have been soaring by $1000’s over the last few months -- driven up by high demand and the same chip shortages that are hindering the new vehicle market.

- There’s incredible price volatility from state to state. We’re seeing $3000 - $6000 price differences for the same vehicles across state lines.

- The used Tesla ecosystem is such a big part of the overall used EV market that it makes sense to look at how that’s evolving. Tesla.com itself is a player, but it only represents 7% of the used Tesla inventory, a far cry from its complete control of new Tesla sales.

State by State Pricing Shows Huge Variability for Popular EV Models

Like many things, used EV prices vary from state to state. There isn’t a hard and fast rule about where EVs are more expensive, including the biggest EV states like California, but there is a very wide range in the prices for popular models state to state. It’s common to see a $5,000 spread between the least and most expensive states.

Drilling into the Used Tesla Market: Lots of Choices

Does the direct-to-consumer sales model hold for pre-owned Teslas? We found that only 7% of today’s used Tesla listings are on tesla.com.

April 2021 Report

- From last month, the overall trend in the used EV market is a decrease in inventory - in particular, GMs, Teslas, and Fiats are being bought up faster than their stock can be replenished. Dealerships across the country are noting inventory shortages on used vehicles in general -- as an indirect result of slower-than-expected new vehicle manufacturing.

- Despite these recent decreases, March inventory is still 37% higher than July 2020 signaling increased interest in used EVs.

- 2018 models have now surpassed 2017 models as the most popular used EVs on the market.

BMW Leads Used EV Market

Last month, we saw Teslas hold their place as the most common used EV on the market. However, the used stock of almost all EVs decreased through March - except for BMW. Perhaps it’s anticipation for the forthcoming i4, or delivery of new i3s, but there has been an increase in the availability of used 530e’s, 330e’s, and the X5 - xDrive40e. If you’ve been keeping your eye on one of these models, it may be a good time to check prices, as the average has dipped slightly in the past month. Used i3’s, on the other hand, continue to retain their value and even showed slight price increases, with 2018s being the best represented year in the market and 2017s at their heels.

Examining Cost per EPA Range Mile

One way to look at used EV prices is by comparing cost per range mile using EPA estimated range. One thing to keep in mind is that EPA range specifies how far your EV will go when the battery is new. EV batteries degrade based on age, how they have been driven, and how they have been stored. To really understand the value of an EV, it is critical to understand the battery in its current state, after several summers in the driveway or several hundred charging cycles.

March 2021 Report

Seasonality exists in used car sales and due to COVID-related economic changes, but this trend is real. Used car sales follow a predictable time delay, peaking at 3-4 years after being sold new. This pattern exists in electric vehicles as well: Six months ago, the most common model year for sale in used EVs was 2017 by far. Now, there are nearly as many 2018 model year used EVs for sale as 2017’s.

The Most Popular Used Electric Cars in March

- Used Tesla Model S, Model 3 and Model X are a large and growing part of the used electric market.

- BMW EVs are a surprisingly strong part of used EV inventories, but it’s not the i3’s that are growing in supply. Instead, there’s been a surge of the availability of BMW’s plug-in hybrids (5-Series 550e, 3-series 330e and the X5 xDrive40e) in the last 6 months.

- Despite the Nissan Leaf being one of the most recognizable EVs on the road for years, it’s only the 4th most popular used EV for sale today.

How do older EV batteries hold up?

EV owners and shoppers perceive that EV batteries last just seven years (Cox Automotive study), but the reality is generally better. A lot of factors play into the battery life of each EV over its life, including manufacturing variances, pack layouts and cooling systems, calendar age, use, temperature history, charging behavior. In our data analysis of 1000’s of EVs on the road, we’ve found that odometer reading alone isn’t particularly helpful in understanding each vehicle’s battery life.

-p-500.png)

.png)